Car towing & recovery services are extremely important when sudden vehicle problems arise on UAE roads. Therefore, many drivers frequently ask whether insurance in UAE actually covers towing and recovery expenses. This blog explains the topic clearly while helping readers make informed decisions with threestarcarrecovery, a reliable UAE-based service provider.

Understanding Car Towing & Recovery in UAE

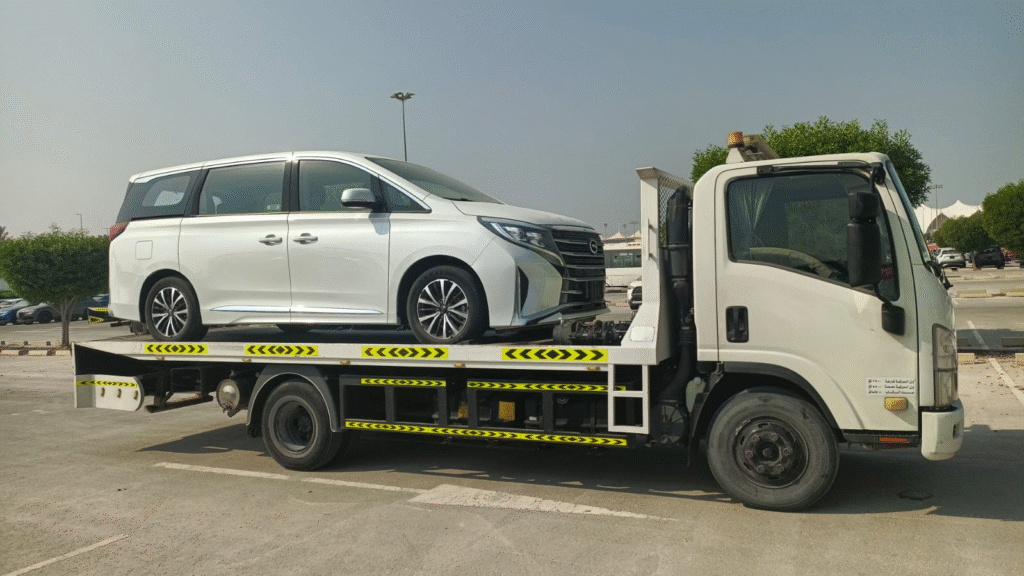

Firstly, car towing & recovery involves transporting vehicles after breakdowns, accidents, or unexpected mechanical failures. Moreover, UAE traffic rules require vehicles to be cleared quickly for safety reasons. Consequently, recovery services become essential for avoiding fines and traffic congestion.

Additionally, professional recovery providers ensure safe vehicle handling. As a result, drivers reduce the risk of further damage and costly repairs.

Does Car Insurance Cover Towing & Recovery?

Generally, insurance in UAE may include towing coverage, but this depends entirely on the policy type. Comprehensive insurance usually offers basic towing and roadside assistance. However, third-party insurance mostly excludes recovery services.

Furthermore, insurers often apply distance or cost limits. Therefore, any towing beyond those limits may require extra payment. Similarly, recovery in remote or off-road areas may not be included unless additional coverage exists.

Types of Insurance Coverage Explained

To explain further, comprehensive policies typically cover towing after accidents. Meanwhile, breakdown-related towing may require an optional roadside assistance add-on.

Moreover, some insurers only approve specific recovery companies. Hence, using an unapproved service may result in claim rejection. For this reason, understanding policy conditions before emergencies remains extremely important.

When Insurance Does Not Cover Towing

Unfortunately, insurance coverage does not apply in every situation. For instance, negligence, policy expiration, or driving violations may cancel coverage. Likewise, repeated breakdowns caused by poor vehicle maintenance can lead to denied claims.

Additionally, long-distance towing and off-road recovery are often excluded. Therefore, independent recovery services like threestarcarrecovery become a dependable solution.

Why Choose Professional Recovery Services

Meanwhile, professional recovery providers offer fast response times and clear pricing. Moreover, threestarcarrecovery delivers dependable car towing & recovery services across the UAE.

Besides that, trained operators handle vehicles carefully. As a result, drivers experience less stress during emergencies and avoid unnecessary vehicle damage.

How to Check Your Insurance Coverage

Before problems occur, reviewing insurance documents carefully is always helpful. Additionally, contacting the insurer directly provides clarity about towing limits and conditions.

Furthermore, adding roadside assistance riders can enhance coverage significantly. Therefore, planning ahead always proves beneficial for UAE motorists.

Final Thoughts

Ultimately, car recovery coverage in UAE depends on insurance type and policy details. However, relying solely on insurance may leave service gaps. Therefore, combining insurance awareness with trusted providers like threestarcarrecovery ensures complete roadside protection.

Consequently, informed decisions lead to smoother journeys. Moreover, proper preparation always keeps drivers safe on UAE roads.

Also Read: How Fast Car Towing & Recovery Trucks Reach You in Dubai? +971528483348